The Top 3 Things To Understand The True Cost of Attending College Before Applying

Recently I was click-baited by the headline, “Teen Accidentally Films the Moment She Finds Missed $104,000 Scholarship Offer in Unopened College Acceptance Letter.” Link to article. This reminded me of at least two things: 1) Facebook’s algorithm knows that I love stories about college admissions, scholarships, and the world of higher education, and 2) if families truly understood the cost of college before applying, they, too, would be able to secure these types of scholarships.

That’s why the information in my last webinar, Understanding the True Cost of College Before Applying (link to replay), is such an important part of the college process. Determining financial fit is something I suggest families do very early on in the process, even before applying to colleges. In the College UnMazed student workbook that I co-authored with Dr. Richard Lapan and Dr. Timothy Poynton, it is one of the areas of college-going readiness that we have students explore as early as 9th and 10th grade. While many families understand there are scholarships and financial aid out there, many don’t know the critical information and terminology about paying for college or even where to find it.

While I suggest you watch the webinar, here are three key steps you need to take to find the true cost of college prior to attending.

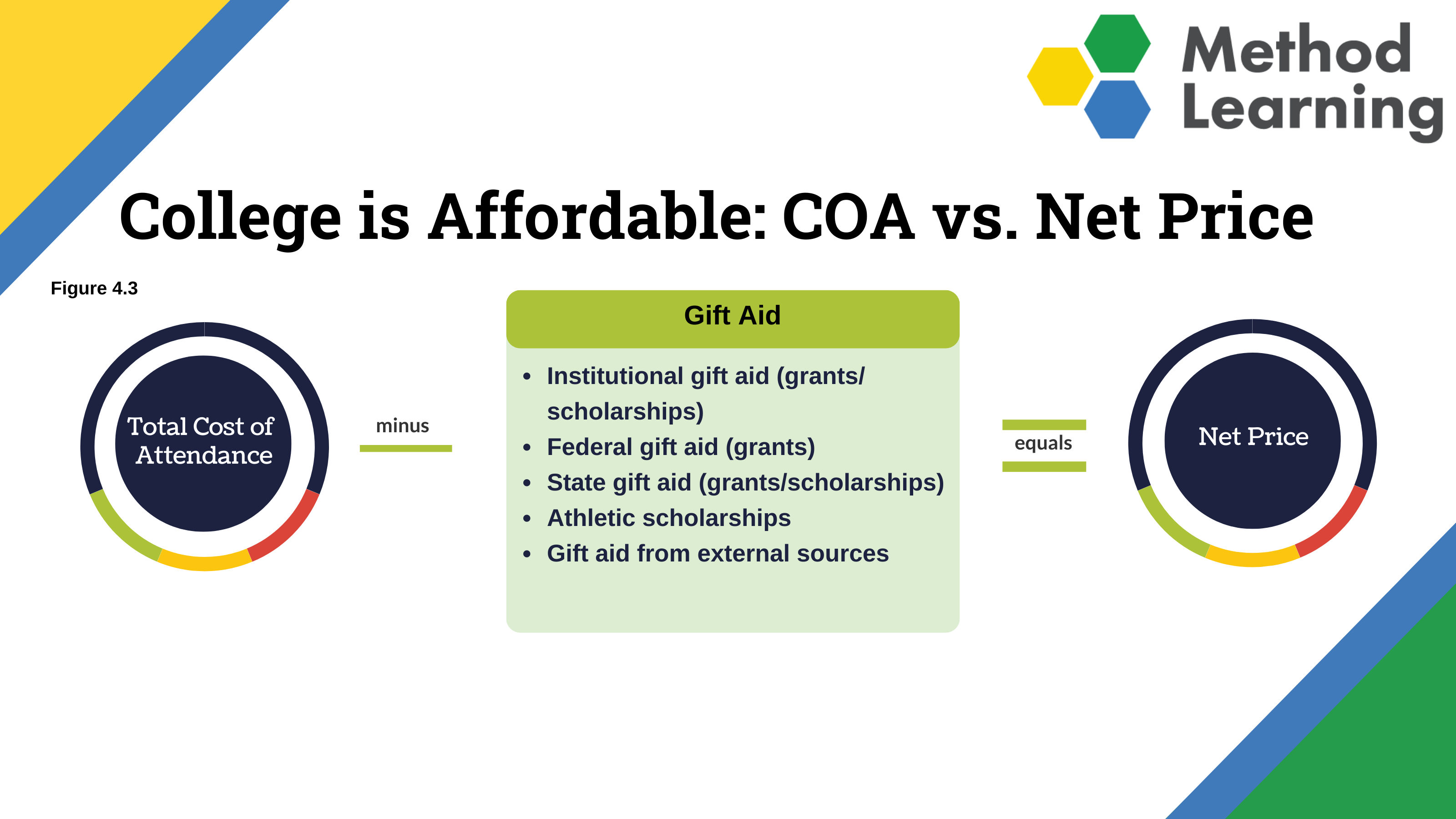

- Cost of Attendance vs. Net Price. There are two prices that families should understand prior to applying. Cost of Attendance (COA) is often considered the “sticker price”, or what you see on the college’s website, which includes tuition, fees, room and board, and other indirect costs like books, supplies, transportation, loan fees, and other miscellaneous expenses. However, the Net Price is the cost that families should pay more attention to, as this is the COA minus any federal grants or institutional scholarships the student may qualify for. Surprisingly, only 14% of students pay full COA, meaning almost 9 out of 10 students pay a reduced rate! Finding out the COA and the net price are rather simple: we suggest using the website College Navigator, run by the National Center for Education Statistics. Under the tab “Tuition, Fees, and Estimated Student Expenses” you can find the COA, and under “Net Price” you can find the average net price.

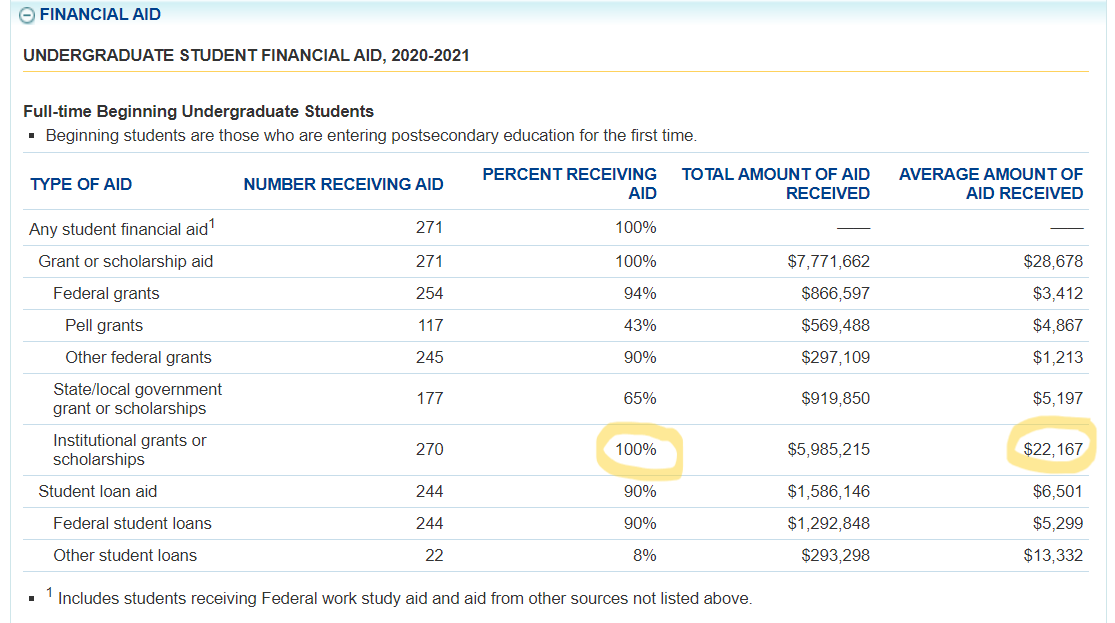

- Know the Percent of Students Who Receive Institutional Aid. The next key thing to understand is to find out how many students actually receive some type of institutional aid from that college, as well as the average net price by income. By reviewing the college’s information under “Financial Aid” in the College Navigator, you can find how many students actually receive aid. So, in looking at Maryville College, the school that offered the scholarship to the TikToker mentioned above, 100% of students receive an institutional scholarship and on average it is over $22,167. Additionally, students earn, on average, around $28,678 worth of total aid, including grants and state/local scholarships! If I multiply this by 4 years, the average student would be on track for a scholarship worth over $110k! While I am not minimizing a student’s hard work to get accepted, the reality is that every student admitted receives a substantial scholarship, and if the student knew this ahead of time, how would that have affected her decision-making process?

- Understanding Your Net Price. The last step in the process will take a bit more work. Now that you know a college’s COA and average net price, you can determine what your net price might be depending on your family’s income and the student's academic factors (test scores, GPA, etc). Each college provides its own Net Price Calculator, link to Net Price Calculator Center, to make this calculation. Each calculator will ask you a series of questions, such as:

- Do you plan to apply for financial aid?

- How old are you?

- Where do you plan to live while attending this institution?

- Are you eligible for in-state/out-of-state tuition?

- Are you (the student) married?

- Are you (the student) the primary source of financial support for any children?

- How many people are in your family's household?

- Of the number in your family above, how many will be in college next year?

- What is your annual household income after taxes?

- ACT/SAT scores

- GPA

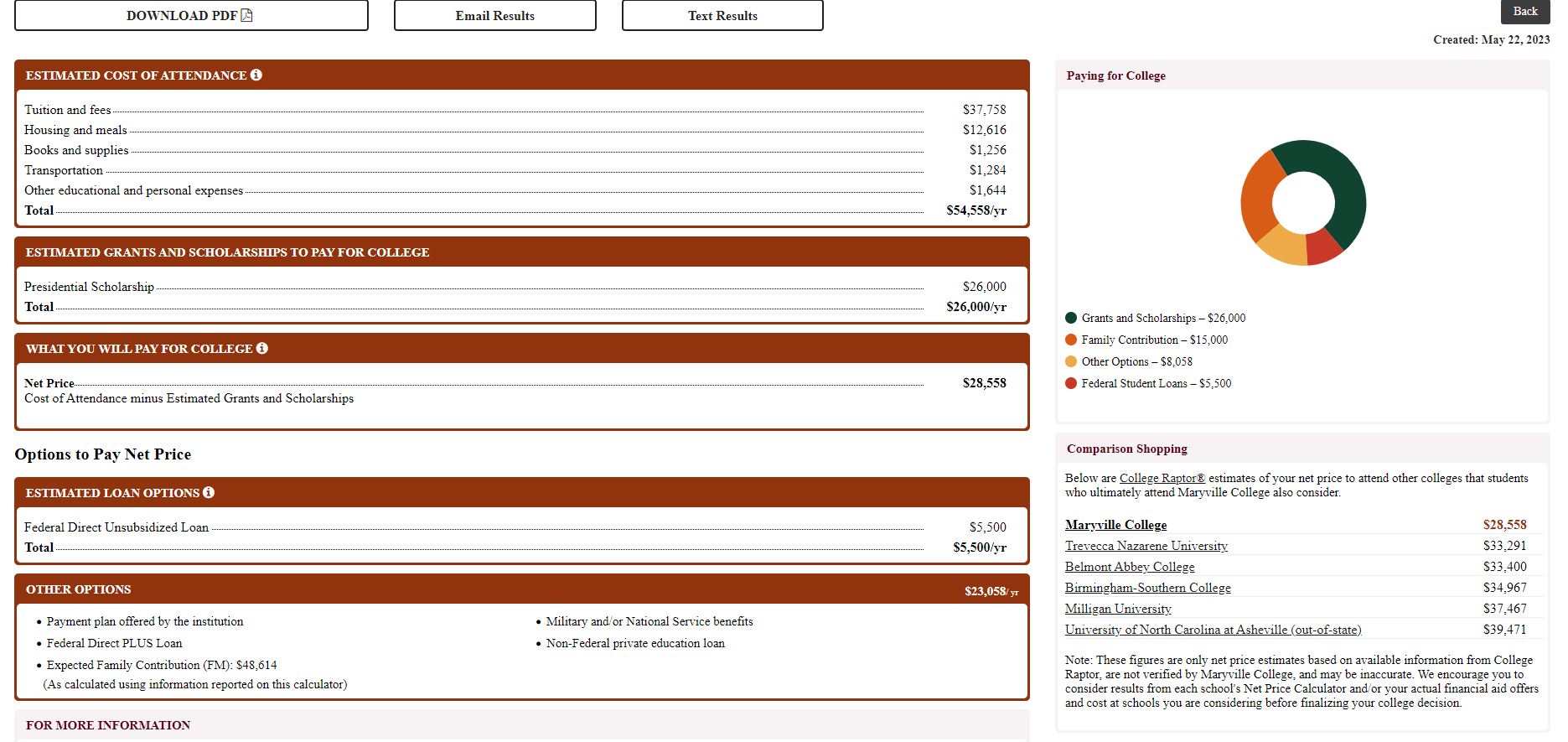

Using the same college and their Net Price Calculator, I simply entered the information based on a fictional student with a good GPA (3.8) and a strong SAT score (1450). With this information, a family can now ask better, more specific questions when they make a college visit and speak with their financial aid department. There may be additional institutional scholarships the student can apply for as well as other external scholarships and programs that could reduce the net price even further. Armed with this information, the family can better compare colleges when making a college list.

The short time spent researching this information will help your family be more informed about the true cost of college prior to applying.

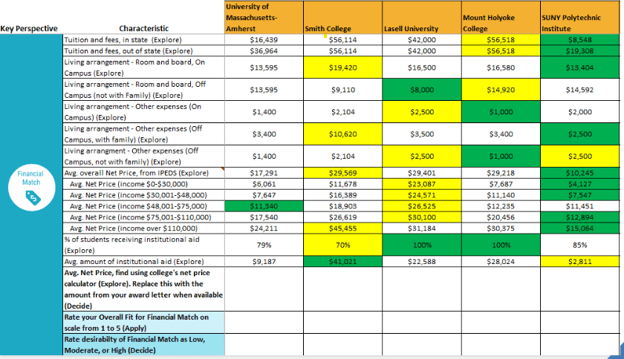

This process of the net price comparison (and more!) is something that we do in all of our College Advising Packages. Diving into the true cost of college early will help families better understand and prepare for what is to come. An example of one student’s college list in the College Data Organizer is shown below. The green, white, and yellow highlights help families compare colleges that are specific to their college list. If you would like to have your own College Data Organizer or have more questions about going through the college process, contact me at amanda@methodlearning.com.